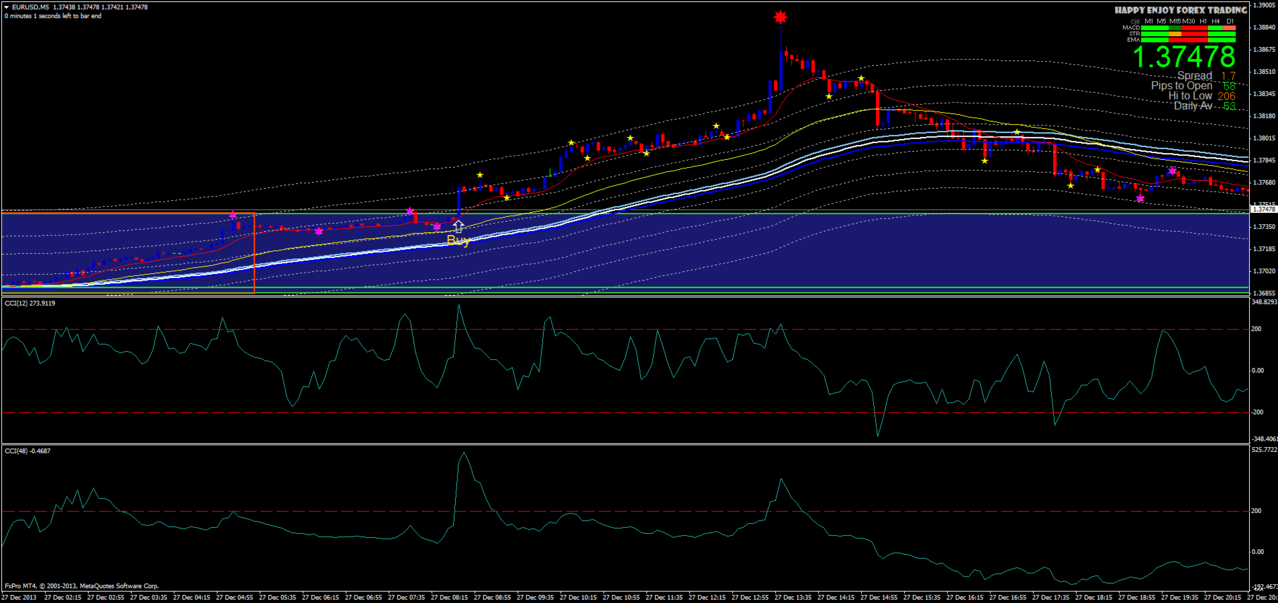

EMA 96 Scalping

alias The Secret of EMA 96 is a scalping approach style following according to 96 EMA tunnel.

Time Frame 5 min

Forex pairs: GBP/USD, EUR/USD

Currency trading Indications

EMA ninety six environment:

1 . Length : ninety six

Shift : zero

Practice to : Standard Expense ( HLC / 3 ) .

Coloration : White

2 . Duration : ninety six

Shift : zero

Practice to : High

Colour : Mild Blue

3 . Period : ninety six

Shift : 0

Practice to : Low

Shade : Dark Blue

There are two supporting warning signs , : EMA 12 and EMA forty eight

Surroundings:

Period : 12

Shift : 0

Practice to : Frequent Rate ( HLC / 3 ) .

Color : Yellow

And EMA 48

Length : forty eight

Shift : zero

Follow to : Prevalent Price ( HLC / 3 ) .

Shade : Green.

Different Metatrader indicators:

a. Sign Bar indicator;

b . Candle time indicator;

c . ZZ Semafor

d . Breakout five panca eagle;

e . Day by day open

1 . EMA 12 and EMA 48 shows the course ( style ) inside the quick time period span of 5 minutes per day ( 240 ) minutes . The intersection with the EMA forty eight EMA 12 MUST BE READ . His rule become hassle-free :

– EMA 12 ( to enable you to be aware : EMA which is smaller ) when chopping EMA 48 from above to under the imply SELL .

– When chopping from the bottom up potential BUY

2 . By the assist of EMA 12 and EMA forty eight , that we will continuously do the OP – OP .

The question is : OFTEN HAPPENS , WHEN WILL intersected ( CROSS ) BETWEEN THE SECOND EMA , Intersect IT DOES NOT ALWAYS TURN FOLLOWED BY TREND ( When using , it will proceed to upward push . Then again if dropped , then it should continue to fall ) . It almost always happens , it appears to manifest CROSS , however just isn’t ! The way to take care of a crisis like this ?

The solution : EMA 96 it truly is the key ! The predominant function , irreplaceable , undeniable , and invariably happen in the foreign exchange pegerakan is FACT that :

1 . When the chart is above the 96 EMA from lower than , then the ninety six EMA line is some degree of beef up.

2 . Conversely , in case the chart penetrate from above 96 EMA , ninety six EMA line then this may increasingly be its resistance factor .

The functions to be memorized from the above indicators :

1 . 96 EMA serves as a pivot / enhance – resistant day-after-day . The above chart shows the ninety six EMA line vicinity BUY ( BUY Zone ) . The chart below presentations the ninety six EMA line place SELL ( SELL Zone ) .

2 . EMA 12 serves as a hallmark of brief -time period developments . The above chart displays the 12 EMA line Bullish . The chart less than displays the 12 EMA Bearish

3 . EMA 48 berfngsu as an extended-term fashion indicator every single day . The above chart shows the 48 EMA line Bullish . The chart lower than displays the 48 EMA Bearish

four . The intersection ( Cross ) with EMA 48 EMA 12 displays a transformation in trend . EMA 12 EMA forty eight minimize from appropriate to backside = bearish . EMA 12 EMA 48 reduce from the underside up = bullish .

5 . CCI forty eight shows the long- term fashion towards day by day ( equal to the EMA 48 ) . Note the level 0 . It’s fabulous . Stage 0 = EMA ninety six = point pivot / beef up / resistance

6 . CCI 12 ( supported via zz mmindicator zemafor or visual ) as elements OP.

rules reasonable purchase and promote

1 . Open TF M5 . Correct-click , decide on Homes , opt for typical , and investigate the box ” show period separators ” .

2 . Zoom out to the smallest TF M5 ( click the ” zoom out ” on the menu till exhausted . Then , click once the ” zoom in ” his .

3 . Two vertical strains that appear inside the chart shows the on daily basis period . Divided into 3 areas by means of making a vertical line . It serves as a cope with market stipulations . Understand , there are three market stipulations :

– Sideways

– Bullish

– Bearish

4 . Sideways is the left-most vicinity . This region starts on the open market till about 10/11 hrs . Properties almost always sideways . In it takes place naik-turun/turun-naik chart actions are extraordinarily small . OP can in basic terms be performed a couple of times merely.

5 . Bullish and Bearish territory discovered on the 2d and third zones . Started out after at 10/11 pm . Mostly , the fashion will commence to seem to be obtrusive between the hours of two:30 to three:00 pm . When Bullish , OP Buy. Optimum breakout takes place at the level of the 576 EMA ninety six . Currently , close place . Concurrently OP SELL with profuse Lot ( notably in shape MM ) . Do the opposite in case the bearish vogue . As we speak , we will OP 5-10 x .

6 . Be cautious getting into the American market . When the breakout has passed off at the end of the European market , mostly can be fashioned again a brand new style . Whether it continues the style of Europe , or the reversal of the style . Hence , be alert to the Information USD . It is terrific . I do no longer advocate to change at the beginning of the American session . Wait till your entire News . Or the time is pointing to the eleven – hrs late .

Leave a Reply