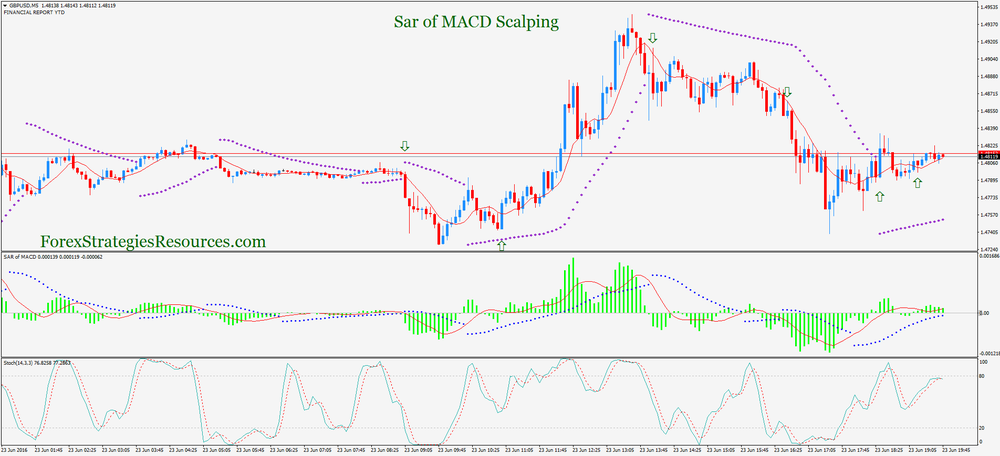

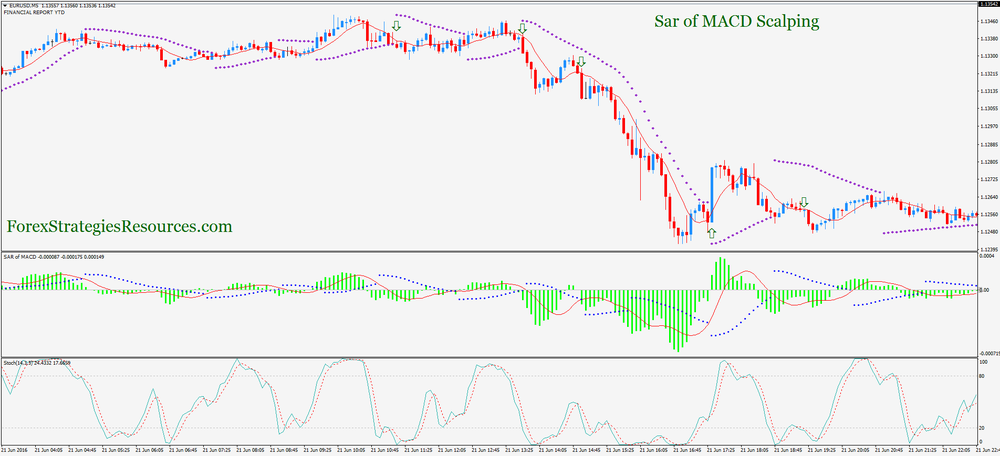

Submit by way of Andreas 23/06/2016

Sar of MACD Scalping is a currency exchange method by means of two parabolic sar and MACD.

This strategy is trend following

Period of time 5 min or 15 min.

Currency pairs: EUR / USD, GBP / USD, AUD / USD, NZD / USD, USD / JPY, USD / CAD , EUR / JPY, GBP/JPY.

Sessions trading: London and New York.

Currency trading indicator:

Parabolic SAR (0.01, 0.1);

SMA 8 period;

MACD (5,eight,9) + Parabolic SAR (0.01, 0.1);

Stochastic Oscillator (14,3,3) optionally available.

Long Entry

When parabolic SAR dots appears to be like under the cost suggests an uptrend sign.

MACD is above 0.

fee is above 8SMA.

Stochastic Oversold stipulations can be visible that the lines already move at stage 20.

Brief Entry

When parabolic SAR dots seems to be above the price indicates an downtrend sign.

MACD is under 0.

price is less than 8 SMA.

Exit place 5 min TF

Income goal 3-7 pips

Location preliminary a end loss at prior swing, or max 10-15 pip quit loss.

Within the images Sar of MACD Scalping in motion.

Share your opinion, might help everybody to take into account the forex procedure

Leave a Reply