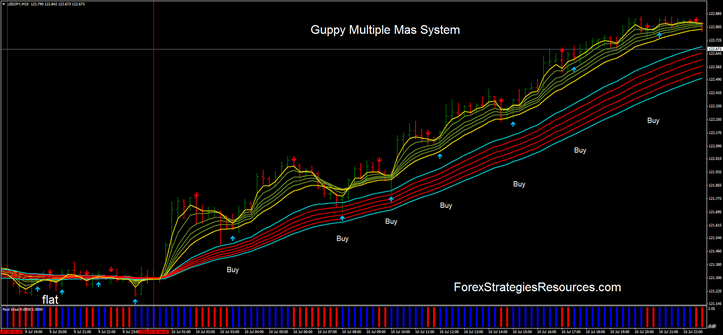

Guppy Distinct Mas process is a vogue following strategy in response to Exponential shifting averages.

Time Frame 15 min, 30 min, 60 min.

Monetary Markets: Forex, Commodities, Indicies.

Expiry time: 3-5 candles.

Metatrader warning signs:

first guppy of exponential moving averages:

3 EMA, 5 EMA, eight EMA, 10 EMA, 12 EMA, 15 EMA.

SDX pivot for intraday trading (optionally available).

second guppy of exponential shifting averages:

30 EMA, 35 EMA, 40 EMA, 45 EMA, 50 EMA, 55 EMA.

Filter arrows indicator(15 min time frame surroundings 30, 30 min period of time environment 60, 60 min period of time setting 240,).

Trading policies Guppy Numerous Mas System

Anticipate alternate setups toward the Guppy Assorted Mas.

Purchase

Buy arrow filtered by

first guppy ema’s above 2d guppy ema’s.

Promote

Sell arrow filtered by way of

first guppy ema’s lower than second guppy ema’s.

Note: Flat Market watch for GMMa separation, No buying and selling when GMMas are combined.

This strategy is additionally really good for buying and selling intraday and swing trading withot binary suggestions.

In the folder there is usually the template for intraday trading.

Inside the graphics Guppy Diverse Mas Technique in motion.

Share your opinion, can help you all people to be aware the currency exchange procedure

Leave a Reply