Divergence Method of the trading.

What ‘s divergence?

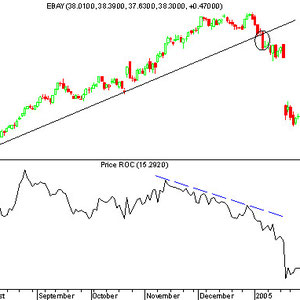

In an up fashion with the intention to setup as a bearish exchange, you ‘ll see the associated fee making bigger highs however you’ll be able to see the indicator making shrink excessive.

In other way?

In an up down taht will setup as a bullish alternate, you ‘ll see the fee making cut down lows however you can actually see the indicator making larger low.

Time Body 5 min= Time expire 60 min.

Time Frame 15 min= Time expire one hundred eighty min.

ATM RSI Histo Triple Stochastic Divergence indicator;

Fibonacci Retracement: XIT Fib indicator.

The price ought to be above the upper Bollinger Bands indicator in case of a bearish divergence and inside the same manner the fee ought to be under the curb Bollinger Bands indicator in case of a bullish divergence.

When the bullish divergence is noticed (time period 5 min), that’s a sign for paying for a 1 hour call preference.

Purchase When the red bars of the indicator ATM RSI Histo Triple Stochastih Divergence retrace less than the dottet black line.

Touch facets are the Fibonacci Retracement: XIT Fib indicator.

Inside the same method when a bearish divergence is noticed (period of time 5 min), it really is a sign for paying for a put choice.

Sell When the blue bars of the indicator ATM RSI Histo Triple Stochastic Divergence retrace less than the dottet black line.

Touch aspects are the Fibonacci Retracement: XIT Fib indicator.

This procedure of buying and selling in response to divergence may be applied to Binary otions recommendations Excessive / Low however this method of buying and selling is absolutely not for newcomers.

Binary thoughts approach one contact Divergence with bollinger bands time frame 15 min

Binary thoughts approach one contact Divergence with bollinger bands time frame 15 min

Share your opinion, can help every person to have in mind the foreign exchange technique.

Leave a Reply